Psychologically, paying off small debts for quick wins is far better for motivation than knowing you’ll be saving interest money, but then that’s my opinion! 4.

This will take ages, and will seriously dent your resolve. If this method is followed, you’ll have to pay off debt 3 first, then debt 5. The problem with this (in my opinion), is that we’re human and we don’t think like this! The avalanche method will ultimately save you the most money in interest repayments, because you start with the debt with the highest interest rate first. This is the method that many in the money industry would be advising you to do. The snowball with a twist is the best one for your psychologically, and I would encourage you to use this method if there is a debt that is especially pissing you off (this is what I will be doing once my flat sells – I have a student loan outstanding and an HMRC tax rebate to pay off – neither have big interest rates, but they both piss me off massively because they put me out of pocket every month by £400!). Can you imagine how much better you would feel by paying that one off first? Yep, bloody awesome that’s what. It’s not the smallest debt, but it is the one that has the most EMOTION surrounding it. If this was me, I would be spitting venom EVERY TIME I looked at money going out to pay it off. Let’s say the £1,000 debt from the first example was to help out a boyfriend, who then ditched you and left you with the bill. This method is EXACTLY the same as the snowball as described, but instead of putting the debts in order of smallest to biggest, you put them in order of which one you HATE the most.

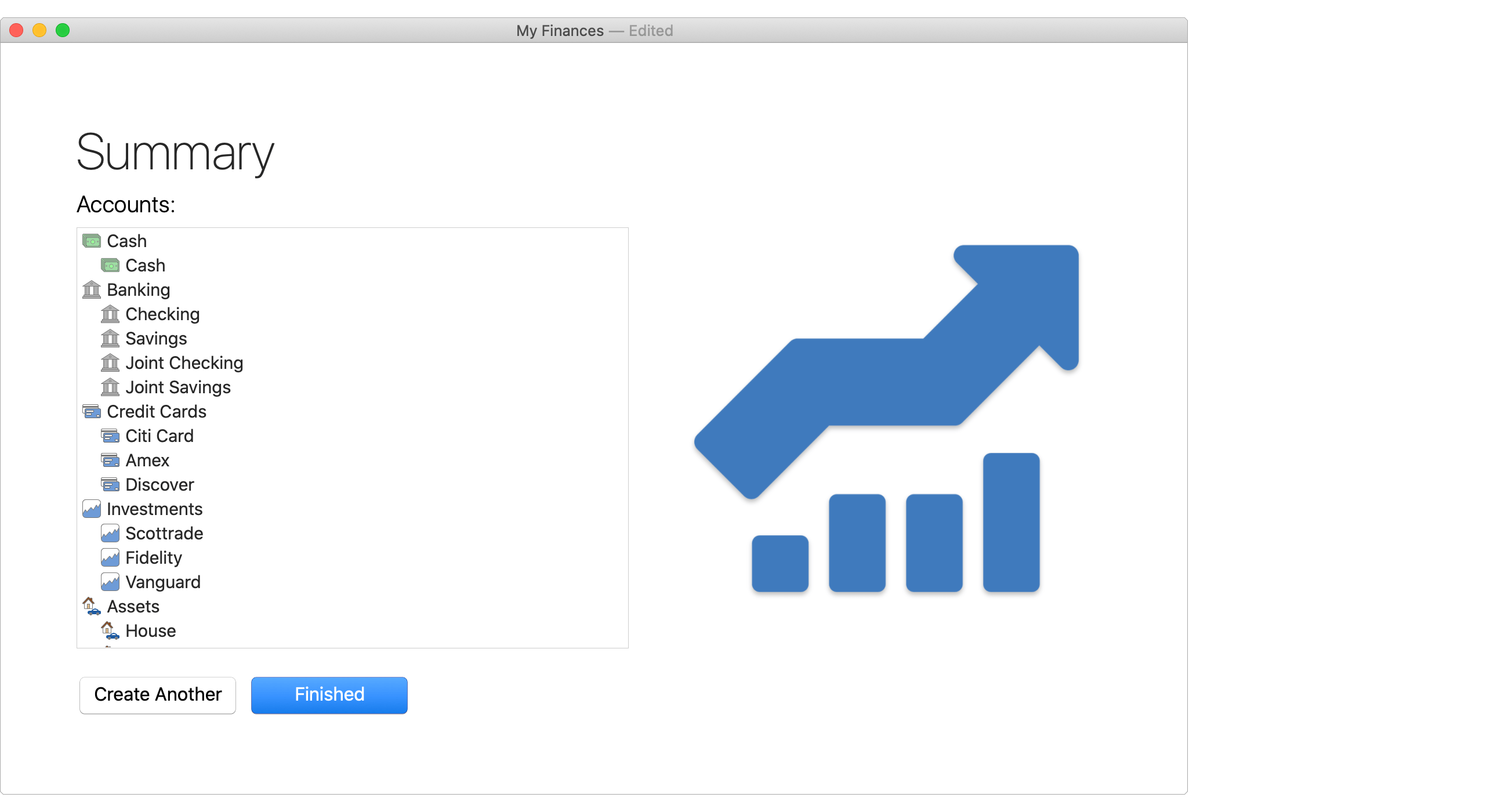

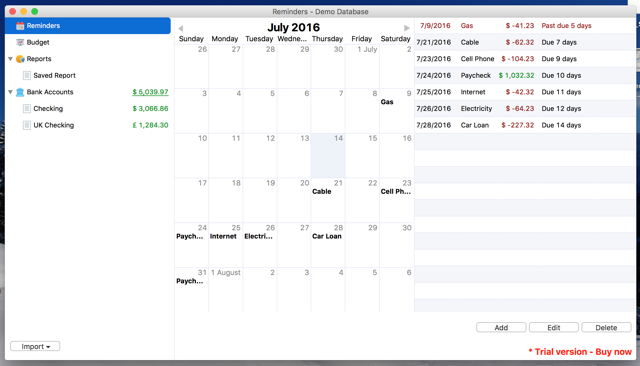

#MONEYSPIRE DOES NOT HAVE MY BANK PLUS#

It helps to pay it off much faster this way, plus I think it works better for your psyche and for your budget this way.īear in mind that interest rates ARE NOT taken into consideration, so does go against conventional wisdom, but I’ll get to this point further down.

#MONEYSPIRE DOES NOT HAVE MY BANK FREE#

Once this is paid off, you’ll have even more spare cash to throw at the next debt and so on.īy the time you get to the largest debt, you’ll have freed up all the minimum repayments from the other 4 debts, plus the extra you found to free yourself from the first one. Once debt one is paid, you’ll have the extra cash every month to throw at the next smallest debt, PLUS the minimum payment you were originally paying on the debt. While this is happening, all you have to do is the pay the minimums on everything else. When you have the spare cash, you throw this at the smallest debt until it is fully paid off. It may be that you need to temporarily give up something to free up some spare cash. The way you do this is by working out how much extra you can pay. The snowball method basically allows you to focus on paying the SMALLEST debt first. Now what a lot of people do is pay a bit of extra off of every debt, and don’t really get anywhere. I have started with this method as I think it is the most flexible and simple, and is the one I use too! I have a free e-book that goes through it in detail, but I’ll summarise for you here. This method appears to be attributed to the money guru Dave Ramsey from the US. ALL of them take persistence, ESPECIALLY if you are in a lot of debt.

Today I’m going to go through some debt pay-off methods to show you what is possible. Some of the methods discussed today will still be helpful in these situations too. So debt is something that affects many people – even if you don’t have credit card debt, you might still have a mortgage or a student loan (this is good debt to have, because in theory, you have purchased something that will benefit you in the long run).

0 kommentar(er)

0 kommentar(er)